Odoo: Growth Plan

Product-led Growth via feature suggestions

Odoo is a suite of business management software tools that helps companies manage their processes.

Understand

Objective: Scale Annual Revenue in India from $4 million to $6 million in next 12 months!

Snapshot of all features

Finance | Sales | Websites | Supply Chain | HR | Marketing | Services | Productivity |

Accounting | CRM | Website Builder | Inventory | Employees | Email Marketing | Project | Discuss |

Invoices | Sales | E-commerce | Manufacturing | Recruitment | Social Media Marketing | Timesheets | Approvals |

Expenses | POS | Blog | PLM | Time off | SMS Marketing | Field Services | IoT |

Spreadsheets | Subscriptions | Forum | Purchase | Appraisals | Events | Helpdesk | Knowledge |

Documents | Rental | Live Chat | Quality | Fleet | Marketing Automation | Planning |

User Observations & Insights

All universal users (Users of competitor products) are unaware of Odoo (67% of our universal userbase). Given below is a summary of main points with at least 60% strength from 66 user & 27 partner calls

Small Businesses with <50 employees

▶️ They currently rely on Google Sheets/ simpler tools: They were looking for plug & play solution for quick integration with their existing tools.

▶️ Looking for multi-purpose tools without breaking bank: Each user is expected to perform a range of functions & hence the solution is expected to support diverse functions.

▶️ Tools that can keep up with their growth: Most of them are scaling up rapidly & expect the tool to smoothen the transition/ cater to the changed state without a performance dip.

Medium Businesses with >50 employees

▶️ Industries with elaborate workflows want to tailor the solution to their specific needs: Odoo's open-source nature, appstore integrations (free & paid) and choice in hosting type (online/ dedicated/ on-premise) provide the users to flexibility to do so.

▶️ They want to have workflows from different functions linked together (73% of users specified accounting, inventory & manufacturing/ sales as the major modules in use): Odoo allows companies to use multiple modules for a fixed cost

▶️ Odoo partners have been a significant source of acquisition (60% of direct users we spoke with got to know of Odoo through partners): Hence, value creation is congruent to how well Odoo is set up by support/partners & their experience with support (success packs) subsequently

USP of Odoo

Well-connected ecosystem & extensive marketplace are the strongest for Odoo, amongst the industry & scale it caters to

USP | Description | Reasoning |

|---|---|---|

Inter-connecting 3 ecosystems - Implementor, Technology & External Business Apps | Odoo has made sure that a well connected ecosystem is shipped to the customer that they can leverage for the best output. | Its very difficult for a B2B SaaS to ensure that all three pillars are well connected to support business scale ups. |

Customizations and Tailoring | Odoo is an open source tool, and users can customise it based on their business requirements, as and when they like. | We heard ‘customisation’ to be a major value prop during user calls. Specially for companies who have complex operations and process standardisations, or evolving requirements that require configuration of several workflows. |

Effective per user pricing | The cost per user on Odoo is very low as compared to it’s competitors. | Multiple users reason to opt for / shift to Odoo was the pricing it gave on both their standard and enterprise plan. |

Localisation and Automation | Odoo has ‘Indianised’ the tool for their Indian customers. | Odoo has done this by providing integrations with locally used tools, Tally for finance, and ability to configure for GST in their Accounting module. |

Ideal Business Customer Profiles

Industry & scale become the most significant attributes for ideal BCPs. BCP2 becomes the most prioritized profile mainly due to high TAM & distribution potential

Three Ideal BCPs

Industry Segment | Retail/ D2C (Hypermarkets, Fitness Studios etc.) | Manufacturing | Logistics/ Dealerships |

Scale | Small & Medium | Small & Medium | Small |

Examples | Heads Up For Tails, Hindveda Pvt Ltd, CureFit | Airlock India, Autoprint Machine Manufacturing Pvt Limited, Esmech Equipment Pvt Ltd | Chennai Metro Rail Limited, Siddhartha Logistics Co. Pvt. Ltd, Toyota Center |

|---|---|---|---|

Business Size | 10-50 employees for small & 50-200 employees for medium enterprises | 6-50 employees for small & 50-200 employees for medium enterprises | 10-75 employees |

JTBD (Functional) | All in one service: One-stop platform i.e., Plug and play the modules they need, & add modules as they grow. | Tool for optimising production schedule by taking into account work orders and resource availability. | Optimising inventory-sales & their support functions via a solution that supports process standardisation |

Time v Money | Money for small & Time for medium entities | Money for small & Time for medium entities | Money |

Implementation Time | 1-2 months for small & 4-6 months for medium | <1 month for small; 3-4 months for medium | 1-2 months for small |

Customisation Need | Medium | Low to Medium | Low |

Hosting Type | Cloud Offering (Some of them use On-premise) | Cloud Offering (Few small entities use Online) | Online & Cloud offering |

Key Pain Points |

|

|

|

Odoo Solutions |

|

|

|

Type of Plan | Custom / Standard (depending on API requirements and built in integrations) | Custom | Custom |

Users per Organisation | 5-10 for small & ~60 for medium | 5-10 for small & <50 for medium | 8-20 |

Average Contract Value | 35,000 - 70,000 (2.5L one-time implementation fee) for small; 5,50,000 - 6,00,000 i.e., server costs with worker, storage, instance charges (partner implementation costs applicable here) for medium entities | Similar range as BCP1 | 56,000 - 1,40,000 (2.5L one-time implementation fee) |

Revenue Potential | Medium since most such orgs are prone to higher growth. Deployment on own server cuts down recurring charges. | Medium to high with monthly fees for using cloud & customisation charges | Low to medium, since potential of revenue contributors is lower |

Influencers | Customer Experience Lead | Odoo partners | Ops Head |

Decision Makers | COO/ IT Head | Manufacturing lead | Founder |

Blocker | IT Manager, Finance Head | IT Manager, Finance Head | Finance Head |

Previously used | Vyapar (very basic small scale inventory mgmt), Webflow, Mailchimp, Tableau | Spreadsheets (Google sheets/Excel), Worksheet, Webflow, Mailchimp, Tally | Spreadsheets (Google sheets/Excel), Zendesk, Netsuite basic, Keka Quickbooks, Calendly, Shopify |

BCP Prioritisation

Adoption Rate | Appetite to Pay | Frequency of Use Case | Distribution Potential | TAM (users/currency) | |

|---|---|---|---|---|---|

BCP1 | Low | Low | Low to Medium | High | High |

BCP2 | High | Medium | High | High | Medium |

BCP3 | Low | High | High | Low | Low |

User Personas within BCPs

ICP Persona | The Founder | Lead Manager, Manufacturing | Supply Chain Head |

|---|---|---|---|

Name | Priyanka Mehta | Vijay Reddy | Rohan Patel |

Age | 34 | 39 | 40 |

Gender | Female | Male | Male |

Education | Bachelor's in Commerce, Diploma in Digital Marketing | Bachelor’s in Mechanical Engineering, Certified Manufacturing Engineer | Bachelor’s in Logistics and Supply Chain Management, MBA in Operations |

Location | Navi Mumbai | Coimbatore | Ahmedabad |

Family Status | Married, one child | Married with three children | Married with two children |

Department | Cross-functional | Engineering | Warehouse and Logistics |

Seniority Level | Highest | Mid Management | Senior Management |

Company Industry | Online Retail (D2C) | Electronics Manufacturing | Raw material delivery for HoReCa |

Company Size | 30 employees | 150 employees | 65 employees |

Business Type | Direct-to-Consumer (D2C), primarily lifestyle products | B2B and B2C Electronics Products | Delivery /Logistics |

Years of Experience | 5 years in retail, 5 years in e-commerce | 15 years total as technician and later as supervisor | 12 years in logistics & supply chain strategy roles |

Technology Adoption | Medium adopter, open to new tech that improves customer engagement but skeptical of having too many solutions | Medium adoption if learning curve is high | High; values technology that improves efficiency and reduces errors |

Digital Maturity | Medium; comfortable with e-commerce platforms, digital payments, and social media marketing | Medium, familiar with smart replenishment strategies like min-max rules, MTO, or the master production schedule | Good: Quite familiar with ERP systems. Experienced with managing large teams & improving productivity |

Decision-Making Style | Looks for market trends and what are cost-effective solutions. | Collaborates with IT, operations, and procurement teams for comprehensive decision-making. | Analytical and heavily reliant on data. Pushes the final decision based on ROI of streamlining ops or tangible benefits to Ops. |

Communication Preferences | Prefers quick communication via WhatsApp or calls for urgent matters. | Prefers detailed reports and discussions via email. | Prefers email for detailed updates, reports and in-person meetings for strategy planning. |

Preferred Sources of Information | E-commerce blogs, YouTube channels, Industry forums, reddit, and 3rd party consultants | Industry trade publications, logistics seminars, LinkedIn, and supplier reports | Industry conferences, Academic journals, alumni on LinkedIn |

Current Problems | Limited control & synergy over tasks | Managing complex, multi-level processes around product manufacturing, quality control, servicing, upgrades & maintaining full records. | Inefficiencies in managing inventory across multiple warehouse locations |

Key Success Metrics (KPIs) | Monthly sales growth, customer retention rate, average order value, website traffic | Production yield, cycle time, inventory turnover, equipment effectiveness, defect rate, CSAT, capacity utilisation | Supplier performance, vendor performance, transportation cost, return rate, lead time, stock loss rate |

Buying Cycle Duration | Short; typically 1-3 months, often driven by immediate business needs | 3-6 months; involves need assessment, solution demos, pilot testing, and final approvals | Typically 2-3 days due to nature of product, with scale evaluation & cost approvals |

Buying Triggers | Need for better inventory management | Poor Forecasting, customer relationship issues, Integration issues, inefficient cost & inventory management | Persistent inventory and logistics issues, Need for improved operational efficiency, Solutioning on centralising data after expansion to new locations |

Decision-Making Process | Primarily makes decisions herself, consults with the head of operations and finance manager | Works closely with IT and operations managers to identify needs and evaluate solutions | Involves consulting with finance and chief operations officer |

Work Style | Highly involved in day-to-day operations, detail-oriented, and values efficiency | Highly organized, focuses on process optimisation, and prefers hands-on problem-solving. Emphasizes team coordination and clear communication | Prefers structured processes, and enjoys problem-solving |

Openness to Change | Open but cautious; willing to adopt new technology if it demonstrates clear cost benefit | Open to change if backed by social proof. Prefers solutions with proven track records | Open to adopting new technologies, especially if they offer clear productivity gains |

Product

🔊Pitch

Are you a growing Indian small or medium enterprise looking for a low-cost business management solution?

Are you tired of maintaining too many Excel sheets, or managing multiple systems to keep your operations running?

It’s time to take control and start automating with Odoo 💯

Why Us? 😎

- All-in-one solution: From Manufacturing, Logistics to Sales, Website creation, Cloud hosting & much more, we have got an all-in-one solution. Leave the manual work behind and focus on your core activity.

- Highly Customizable: Our software adapts to your exact needs, not the other way around. Our modular, open-source platform empowers you to use what you need, when you need it.

Get in touch with Odoo partners & implementation team if you need more clarity on how Odoo will do these for you. Let’s simplify and grow together! 🌍

Modules and Features

Industries using the most modules are manufacturing SMBs in sectors like automotive, textiles, electronics, food processing, etc.

All Features

Odoo Features | Usage | Target Industry |

|---|---|---|

CRM | Manage customer relationships, track leads, automate sales workflows, and enhance customer engagement. | All industries (Retail, Manufacturing, Services, etc.) |

Sales | Create quotations, manage orders, automate invoicing, and track sales performance. | All industries |

Accounting | Manage financial accounting, tax management, and real-time reporting. | All industries |

Inventory Management | Manage stock levels, track products, optimize supply chain, automate reordering, and deliveries. | Logistics, Manufacturing, E-commerce, Servicing stores etc. |

Manufacturing (MRP) | Manage manufacturing processes, bill of materials (BOM), production scheduling, work orders, and quality control. | Manufacturing |

Purchase | Automate procurement processes, manage purchase orders, track supplier performance, optimize purchasing efficiency. | Retail, Manufacturing, E-commerce, Wholesale, Logistics |

Human Resources (HRM) | Manage employee records, payroll, attendance, recruitment, and appraisals. | All industries |

Project Management | Plan, track, and collaborate on projects, set timelines, assign tasks, monitor progress and performance. | Services, Construction, IT, Engineering, Consulting, Manufacturing, B2B Logistics |

Marketing Automation | Automate email campaigns, manage social media, create lead nurturing workflows, track marketing ROI. | All industries |

E-commerce | Build and manage an online store, integrate with inventory and sales, process payments, and optimize product listings. | E-commerce, Retail |

Point of Sale (POS) | Manage retail operations, process in-store sales, handle payments, sync with inventory and accounting. | Retail, Hospitality, Food & Beverage, Boutique |

Website Builder | Create and customize websites, integrate with e-commerce, blog, and other Odoo modules. | All industries |

Expenses Management | Automate employee expense reporting, approvals, and reimbursements. | All industries |

Field Service Management | Schedule and manage field service teams, track service tasks, optimize routes for field workers. | Utilities, Maintenance, Manufacturing, Delivery platforms |

Helpdesk | Manage customer support tickets, automate ticket assignment, and track issue resolution. | All industries |

Timesheets | Track employee time on tasks and projects, generate reports, integrate with payroll and invoicing. | All industries |

Studio (Customization Tool) | Customize Odoo apps, build new modules without coding, tailor workflows to business needs. | All industries |

Subscriptions | Manage recurring subscriptions, automate billing, track subscription revenue, handle upgrades/cancellations. | SaaS, Media, Subscription-based businesses |

Fleet Management | Track vehicle fleet, schedule maintenance, manage fuel consumption and costs. | Logistics, Transportation, Delivery Services |

Payroll | Manage employee payroll, generate payslips, calculate taxes, integrate with accounting and HR modules. | All industries |

Document Management | Store, share, and organize business documents, collaborate with teams, and automate document workflows. | All industries |

IoT Integration | Integrate IoT devices with Odoo to automate industrial processes and gather real-time data for analysis. | Agriculture, Studios, Medical labs |

Event Management | Plan and manage events, handle registrations, track attendance, automate event marketing. | Media, Hospitality, B2B SaaS |

Appointments | Schedule and manage appointments, send reminders, integrate with calendar apps. | Healthcare, Wellness, Beauty, Professional Services |

Social Media Marketing | Plan and schedule social media posts, track social engagement, automate social marketing workflows. | D2C, Travel, Wellness, Media |

Rental Management | Manage equipment or product rentals, automate rental agreements, track rental inventory. | Equipment Rental, Real Estate, Construction |

Trade-offs

The issues were faced most by users who did self-onboarding, & many of them subsequently became churned users

Major Issues

Downside | User journey | Description | Reasoning |

|---|---|---|---|

Difficult implementation | During implementation | Odoo implementation is fairly complex for organisations who are looking to do it themselves. | Most customers have some business requirement which needs to be custom-built & this is usually difficult to do without a Partner / Developer. |

Long time to value | Onboarding and implementation | How well the product is customised, and if all customers are able to derive the perceived value of the tool. | In most cases, it took customers months to find value as the set up was not done as per their requirements / setup took longer due to customisations. |

User training | Post-onboarding and implementation | User training is essential as otherwise Odoo is a difficult tool to use. | Odoo is a fairly complex tool for users to grasp, specially if they have not used ERPs before, or are not well-versed technologically. Users cited the tool as ‘difficult to use’. |

Limited agility for high-velocity growth | Post-implementation | Odoo has difficulty to adapt to rapidly changing requirements, making it less suitable for organisations experiencing high-velocity growth. | Customers shared that Odoo was unable to cater to deeper customisations, say at an attribute level. It was derived that Odoo is good for orgs which have fairly standard processes with minimal depth. |

Blockers for Odoo developers | During implementation | There have been inconsistent reviews from Odoo developers. | Odoo developers reported that fixing backend issues is easier than frontend as there is a lack of documentation for any frontend issues. Also, it is difficult for them to fix frontend issues as it is only compatible in XML. |

Inefficient resolution by Odoo Support | Post-implementation | Odoo support is highly inefficient as their TAT is really high for basic bugs/issues. Additionally, there is a cost to get on a call with Odoo Support. | Many customers mentioned that Odoo’s support had taken long to resolve basic bugs, or even chose to not resolve it. Customers have to pay further to get on a call with Odoo Support. |

UI and Performance Issues | During and post-implementation | Odoo can be slow, and there’s a general feedback that the UI is not intuitive. | Customers with large no: of users, or huge data sets have faced performance issues with Odoo. It slows down when used with Native servers. The UI is not intuitive, & the user is sometimes unable to navigate through the product. |

Customer Perception vs. Brand Positioning

Odoo helps to build digital roadmap for firms & achieve operational efficiency. However, their attempt to position as a tool for companies of all sizes has not been successful since even loyalists perceive the tool as suitable for only SMBs.

Customer Perception

Odoo’s most valued benefits seem to be its low-cost and customizable ERP solutions.

- During our primary research, we observed a trend of first-time ERP users seeking solutions that would bend around for their business needs.

- Partner discussions focused on customization, based on nature of business. Once implemented, the workflows largely remain unchanged for long periods.

- Industry leaders have validated Odoo as their go-to solution due to its architecture supporting a system-oriented approach, enabling master data management & process standardization, which are crucial for sustained usage in specific industries like discrete manufacturing, trading etc.

- Our interactions with loyal users & implementers indicated a strong affinity - beginning with contributions through the Odoo developer community. They gained experience in customizing the solution for other end users & continued to use the platform in their own ventures.

Brand Positioning

Odoo does not want to limit its positioning to businesses of a certain scale. They are aiming to expand breadth of usage for their client base while emphasizing pricing, which has been a key entry lever.

Contradictions to Brand Positioning

Aside from partners or loyalists, many users perceive Odoo as a solution primarily for small to medium-sized enterprises. The platform’s user experience & highly segmented modules contribute to this perception.

- When data needs to be broken down into highly modular units with little repetition, the process becomes tedious. E.g.: a user in construction manufacturing struggled with component variations, making the experience difficult. Another user in EV manufacturing faced issues onboarding 5-6 years of data.

- An ex-gold partner noted that Odoo’s flexibility is limited for large enterprises unless addressing specific use cases rather than functioning as a general business suite.

- A caveat to Odoo’s ‘attractive pricing’ is the additional implementation costs. Users highlighted opting for direct implementation due to the perceived growing monetary costs of support.

- The cost of a 4-hour support call is INR 18,580 for returning customers and INR 15,793 for new customers. Similar prices for other call durations.

- Odoo.sh, which is their dedicated cloud offering also has additional costs starting at $70 per month, with pricing including:

- Workers: $72 per worker per month

- Storage: $0.25 per GB per month

- Staging Environment: $18 per environment per month

- Secondary research suggests Odoo no longer offers free upgrades after a certain version.

- Non-technical users or those using ERP solutions for the first time face significant additional time and effort costs as a result of this decision.

- The paid integrations & plugins are available for Odoo.sh & on-premise comes with an additional cost per integration. E.g.: A POS Razorpay integration developed by Webkul Software comes with an additional cost of $151.12

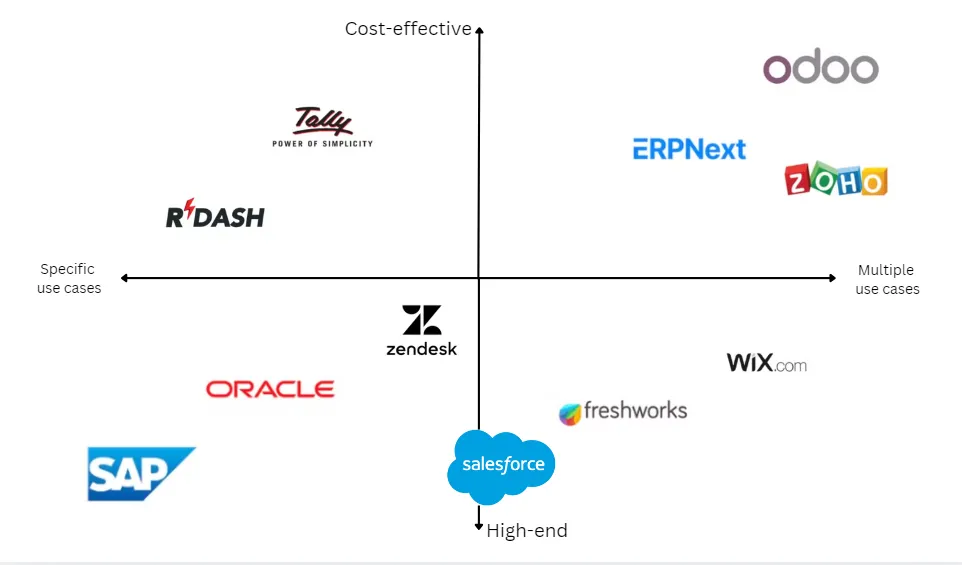

Competitive Landscaping

Benchmarking against major competitors:

What sets Odoo apart? | What is the differentiator for ? |

|---|---|

Cheaper pricing; Higher integrations on marketplace; More tools on Marketing, HRMS, Finance, Project Mgmt | ERPNext: Much better no-code interfaces & higher customisation can be done without a developer; Can handle larger volumes of data |

Specialised tools for POS-Supply chain-Manufacturing and higher customisation due to open source | Zoho: Multiple tools to cater to different scale (E.g.: CRM vs Bigin, where latter is a simple CRM for small businesses). |

Faster implementation cycles; Specialised tools for industries like Manufacturing & higher customisation | SAP: Robust & best in the market for large enterprises with complex needs |

ERPNext | Zoho | SAP | |

|---|---|---|---|

What can Odoo learn from them? | Portrayal of their functionality with industry use cases; onboarding & overall user experiences | Expansion from SMBs to midsize and enterprise categories without compromising on service quality of SMBs | Building a strong brand reputation with deep industry integration and trusted partnerships |

Odoo's Right to Win |

|

|

|

Detailed Table:

Odoo | ERPNext | Zoho | SAP | |

|---|---|---|---|---|

Core problem being solved | Increasing operational efficiencies, setting standardised processes, helping firms focus on their core activity | ERPNext is an open-source solution for functions like sales, accounting, HR, manufacturing, for businesses of all sizes. | Improving processes, system collaboration, data consolidation & report preparation | An integrated solution to manage complex processes across multiple functions (finance, supply chain, HR, procurement, etc.) |

Who are the users? | SMBs across Manufacturing, Logistics, Hypermarkets, Vehicle dealerships, D2C, Hospitality firms | SMBs across Manufacturing, Service providers, Educational institutes, Fintechs and Healthcare Organizations. | Across industries (barring very large firms), especially in service, finance, IT, healthcare, retail & e-commerce, consulting firms. | Large enterprises, multinationals with complex operations. |

JTBD | Optimising schedules & inventory, design customised workflows, onboard one service provider to automate most needs | A cost-effective ERP solution that offers comprehensive features without expensive licensing /customization fees. | Optimise workflows, support for multiple functions in one place, readily available support for adhoc needs | Integrated system to streamline complex operations across functions, ensuring efficiency, compliance, and scalability |

Frequency of use | Core - Daily | Core - Daily | Core - Daily | Core - Daily |

Products they have | 8 modules: Supply chain, Sales, Marketing, Finance, Services, Productivity, Human Resources, Websites | Similar modules like Odoo: CRM, Sales and Purchase, Accounting, HR and Payroll, Manufacturing, Asset Management, Website builder, Helpdesk | 11 categories: Sales, Marketing, Commerce & POS, | Two products: |

Features in each product | 48 apps in total across these 8 modules: As per user calls, high usage for: | Majority of overall functionality overlap with Odoo's; however they have presented services as industry-specific solutions. | 48 apps in total across these modules. As per user calls, high usage for: | - SAP Business One: Can be on-premise or cloud-deployed, with high customization scope with functionalities like financials, sales, and inventory. |

Who uses these features in the org? |

| Similar to Odoo, few other roles found pre-dominantly:

| Similar roles as cited earlier, difference for:

| Usage across more verticals & roles, since larger orgs are clients:

|

Customisation capabilities | Medium to High | Medium to High | Medium | High |

Onboarding experience | Rated bad for slightly complex workflows with few partners and majorly for self-implementations | Partner & self-implementations are rated higher than Odoo. | Dedicated spokes & quicker response time for support were rated highly. | Rated excellent when done with partner who has extensive knowledge; many users fell in this category. |

Time to value | <2 weeks for SaaS offering, ~6 months for customised workflows depending on complexity | Low to medium: 2-3 weeks to 4-7 months subject to complexity, and so the time to value is higher for bigger orgs with high customisation. | 2-4 weeks for most, 1-3 months for complex and multiple setups, | High: Time to value is close to 8-12 months as the time to implement takes long. |

Hosting Type | Cloud (Small taking SaaS or Odoo.sh) and medium largely preferring Odoo.sh | On-premise & cloud (shared vs dedicated cloud). Pricing becomes per app/user with cloud. | 2 variations: Cloud & On-premise. Restrictions on some features being accessed on-premise. However mobile & web versions are possible. | SAP Business One can be on-premise and on cloud. |

UX Evaluation | Many users scored the experience lowly; Functionalities are nested inside pages, making it difficult for new users | Rated better & more intuitive than Odoo. | Overall, rated higher for sales, marketing and finance domains. | More robust but complex, as it is designed for advanced users managing intricate processes. |

Integrations / plugins / marketplaces | High | Medium | Medium (About 3200 apps across all functions) | High |

GTM Strategy | Affordable business suite for all businesses, localised for Indian businesses | Affordable and open source ERP solution for specific industries. | Targets enterprises of all scale globally. (Distribution channels via partner networks) | Targets large enterprises with a global presence through consulting firms, and strong partnerships. |

Have they raised funding? | ~$483M over 5 rounds - Major investors being General Atlantic & Summit Partners | Funded with $1.35 million by Rainmatter (Zerodha incubator) | No external investment so far. | Publicly traded, does not raise traditional funding. |

What pricing model do they operate on? | Enterprise edition charges per user with add on costs basis hosting, support, integrations or upgrade - One app is free for any no: of users. Community edition is free. | For their cloud-hosted service, they follow a tiered subscription pricing strategy. | Per user cost across 4 buckets: standard, professional, enterprise, ultimate. Zoho One follows same pricing, but is more like a bulk user plan for larger firms. | Subscription-based, with high costs for customization, consulting, and additional modules. |

Pricing | 580-890 per user/month for a yearly plan; 760-1140 per user/month for monthly plans | Small business plan at 4100/ month & a custom enterprise plan priced at firm level depending on requirements | 1249-1500 for standard, 3000-3500 for premium (depends on monthly /annual) per firm + custom billing. Per employee (3500-4000) or all employee pricing (1800-2500) options with Zoho One | INR 3599 per user per month or Business One plan, 1500-15k per user/ month & advanced per firm plan under Business By Design |

Brand Positioning | Low cost ERP for small to mid scale businesses, particularly in operationally heavy entities | Open source ERP, made in India, for fast growing modern companies. | Affordable & customisable business suite for firms of all scale and size. | Premium, enterprise-grade solution for complex and large-scale organizations. |

Product-led growth

Feature suggestion strategies:

Snapshot

Objective for SMBs:

To increase number of seats, which in turn drive revenue growth 📈

Reasoning

In medium scale firms, multiple teams would be handling all functions. We intend to get their colleagues on Odoo through current users.

Objective for Very small businesses:

To increase number of apps at least by 1, to make them a paying user 🔢

Reasoning

It is easier to convert consistent users of a single app to a multi-app user as addition of a single feature would get them to at least a standard plan.

Purpose: Recommendations on usage of features subject to industry, frequency and module

Who are we targeting?

Manufacturing/ Logistics firms are the most prevalent star industries of Medium scale & the highest usage from single-app category are for Websites & Sales features as per our user calls.

BCPs

Industry | Module | Min. Frequency | User Count |

Manufacturing / Logistics | Supply Chain Sales Finance | Supply Chain, Project & Sales: Daily usage Finance: Weekly twice | Supply Chain & Sales: Min 5 users Finance: Min 2 users Project: Min 3 users |

Retail /D2C | Sales Websites Supply Chain Finance | Sales, Websites & Supply Chain: Daily usage Finance: Weekly twice Marketing: Weekly thrice | Sales & Supply Chain: Min 5 users Marketing: Min 3 users |

Others | Any | Weekly once | Min 3 users |

Criteria: Frequency OR User count satisfied for any 2 features from Module in 2 months after taking a paid plan

Single-app users

Module | Min Frequency | Monitoring Period |

Websites (eCommerce or Website Builder) | Daily | 1 month |

Services (Appointment) | 2-3 times a week | 1 month |

Sales (PoS or CRM) | Daily | 1 month |

Marketing (Events or Surveys) | Once in 2 weeks | 2 months |

Finance (Invoicing or Accounting) | Once a month | 2 months |

Criteria: Frequency met for any feature who are on one-app free plan for monitoring period

Engagement Framework

Engagement framework | Relevance | Key metric to be tracked |

Breadth | Primary | Increase in count of users per firm is the final metric that has a high impact on revenue. Increase in no: of features is a sub-lever to get here for BCPs & has a revenue contribution for single-app users. |

Depth | Secondary | Time spent on app, to gauge the value user is deriving from Odoo. This is only an indicator to whether the user could be a prospective client for pitching more features. |

Frequency | Tertiary. Scope is contextual to the feature /industry/ scale. | No: of business transactions (E.g.: count of quotations sent, count of meetings scheduled) |

Plan of Action for BCP

We have categorised our BCPs into 3 groups based on whether decision maker or influencer is currently our user. Idea was to prioritise the segment where we can interact with decision maker & there is high scope of bringing in more users.

Classification of categories

Category | Reasoning |

1 | Decision maker is already our user |

2 | Influencer is our user |

3 | Specific workflow & utility exists; Need to identify & target influencer / decision maker |

The top 2 feature pitches are for ‘WhatsApp’ to D2C clients & ‘Field Service’ to Manufacturing or Logistics clients, where decision makers are already our users

Possible combinations of industry & features:

Sr. No: | Industry | Module | Other parameters | Top Feature(s) to be proposed | Influencer | Decision Maker | Category |

1 | Manufacturing / Logistics | Supply Chain AND/ OR Sales, Finance, Project | - | Field Service | - Manufacturing lead role in workflow | Manufacturing lead role in workflow | 1 |

2 | D2C/ Retail | Sales + Websites + Supply Chain AND/OR Finance, Marketing | - | Integrating WhatsApp for customer communications | - Sales lead role in workflow | - Sales or Marketing lead | 1 |

3 | D2C/ Retail | All 5: Sales, Websites, Supply Chain, Marketing, Finance | If events feature is still not used | Events | - Sales or Marketing lead roles in workflow | - Sales or Marketing lead roles in workflow | 1 |

4 | Any | All 5: Sales, Websites, Supply Chain, Marketing, Finance | - | Approvals | - Sales or Marketing lead roles in workflow | - HR or Finance Leads | 2 |

5 | Any with delivery applicable (E.g.: Food, Grocery, Pharmaceuticals) | Any (but not yet doing Fleet management) | Pre-requisite: Client handles this logistics | Fleet | - Sales lead | - Warehouse lead | 3 |

6 | Any with data recording on other hardware (E.g.: Studios, Medical Labs, Printers) | Any (but not yet using our IoT tools) | Not more than 250 employees | IoT | - IT operations or Database System Admins | - IT or Finance Leads | 3 |

7 | Any | Only using <3 apps (Maybe recent onboarding) | >100 employees | - HRMS Integration to get data - Sales or project workflows | - Sales lead | - Business or IT Heads | 3 |

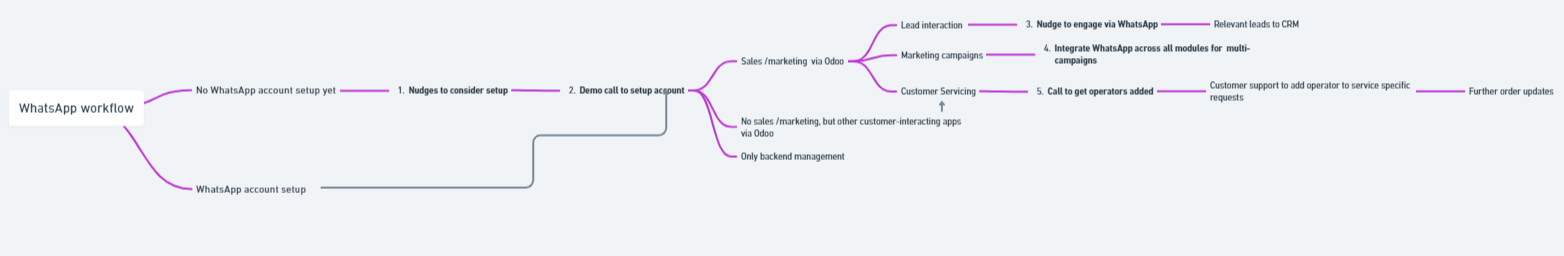

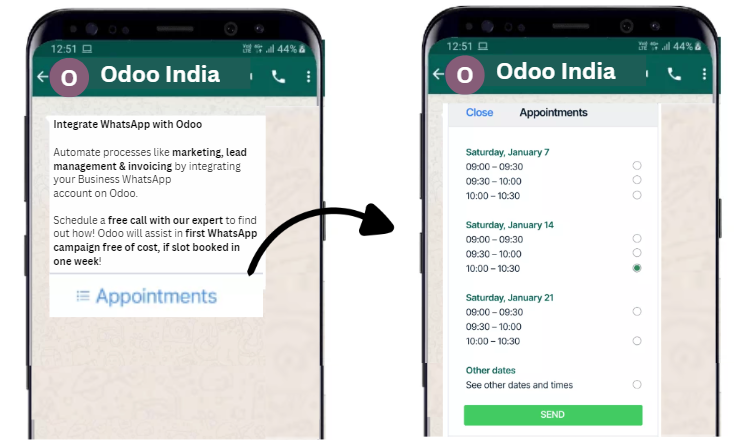

Feature #1: WhatsApp

Why WhatsApp

- Increasing propensity for businesses to use WhatsApp for communications

- Launched only a year ago (In September 2023)

- Adoption of WhatsApp for marketing fairly high for new onboarding, as per partner calls

- Use cases across modules (Sales, Customer Support) for any Retail enterprise

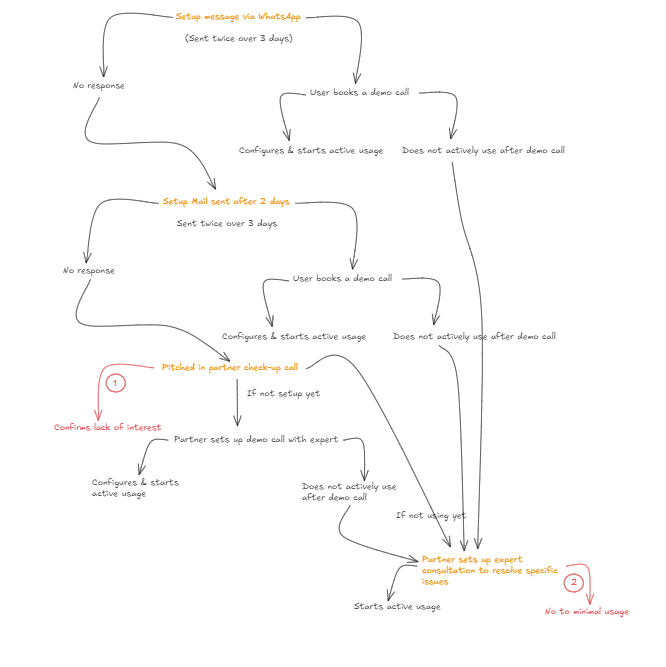

Communication Flowchart:

4 touch points starting with Odoo WhatsApp message, mail & partner check-in calls which we are introducing via Partner standardisation

The Flowchart

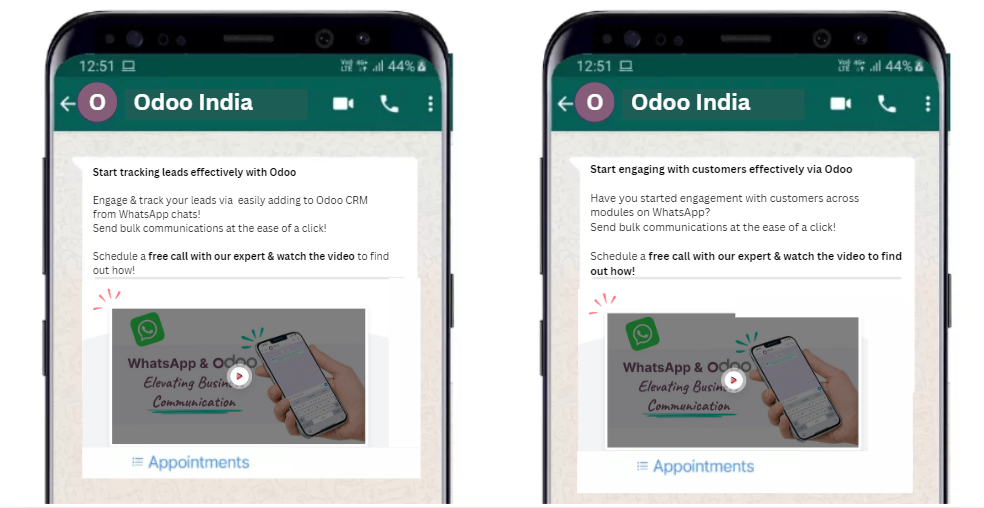

Use cases across modules

Adding leads to CRM module from chats; Integrating across all modules & easily triggering bulk messages; Adding operators to respond to specific customer enquiries

Feature workflow

Step 1: Nudges for WhatsApp setup

CTA to book a slot and Offer that Odoo will do first WhatsApp campaign free of cost. This step is for clients who have not yet published a WhatsApp account.

Wireframe

Step 2: Demo call to setup account

🕤45-minutes Google meet link

☑️Expert sets up a WhatsApp account for the client: 15 mins

❓Probes about relevant use-cases & gauges best scenarios to demonstrate: 10 mins

❇️Demonstrates 2-3 applicable scenarios of adding & sending messages via WhatsApp: 15 mins

💯Ends the call with steps on how to let partner or support know if any issues faced during configuration & usage: 5 mins

Step 3: Nudge to engage leads & integrate across modules

This step is for those who have published account, but not actively using for lead or customer engagement yet

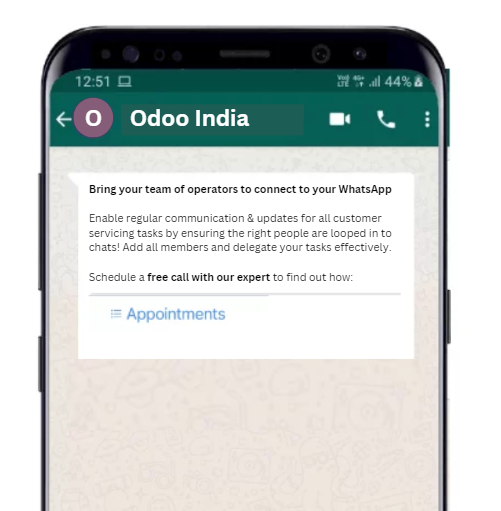

Step 4: Nudge to get operators added

This step is for those who are yet to link operators to official chats, who can respond when specific enquiries are raised

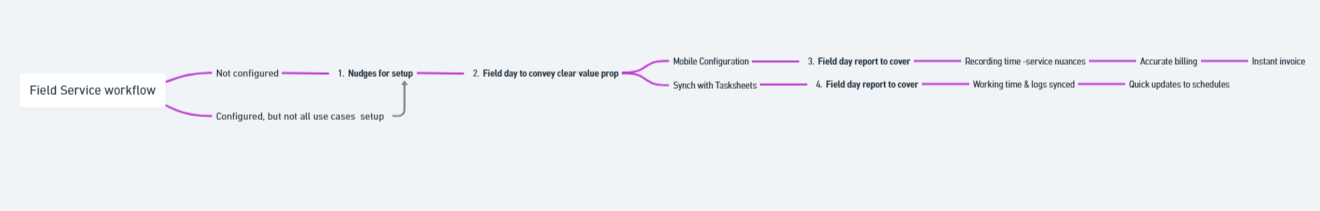

Feature #2: Field Service

- Scope of field service is quite high for our BCP industries

- User calls revealed roles like “sales, core manufacturing or operations” on Odoo currently

- Odoo v18 minor feature upgrades & expected bug resolution for recurring payments

- Hypothesis to onboard field team via this feature

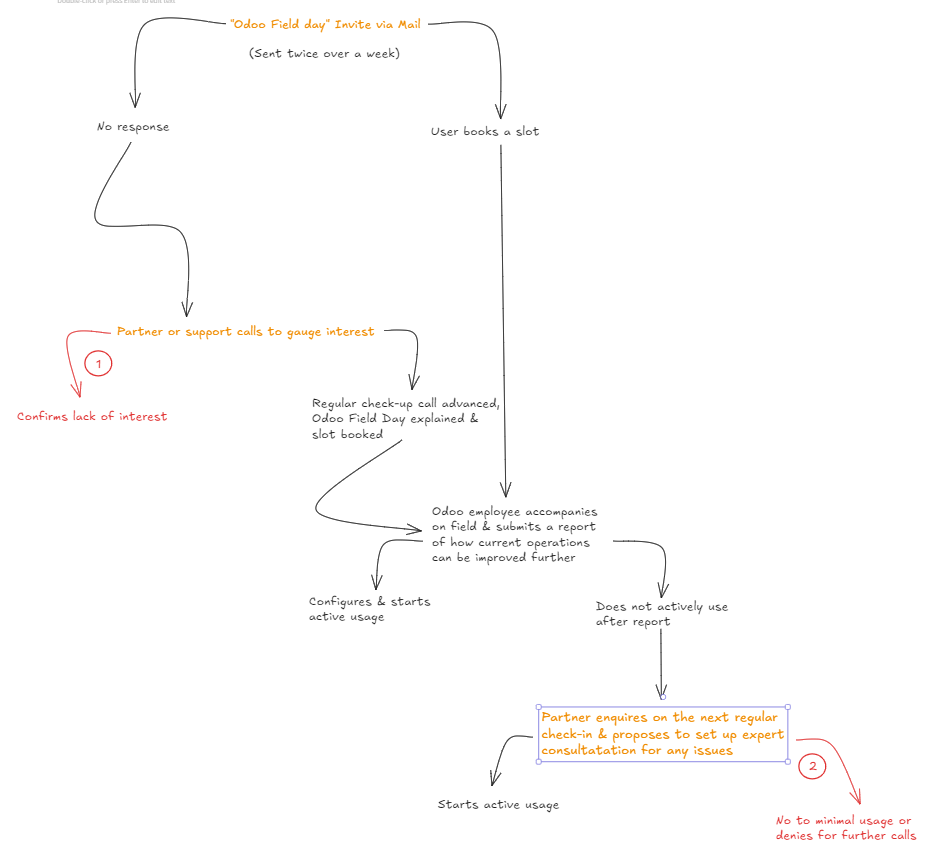

Communication Flowchart:

3 touch points starting with mail invite for ‘Odoo field day’ & partner check-in calls. Proposal is to let an Odoo employee accompany field staff for a day

The Flowchart

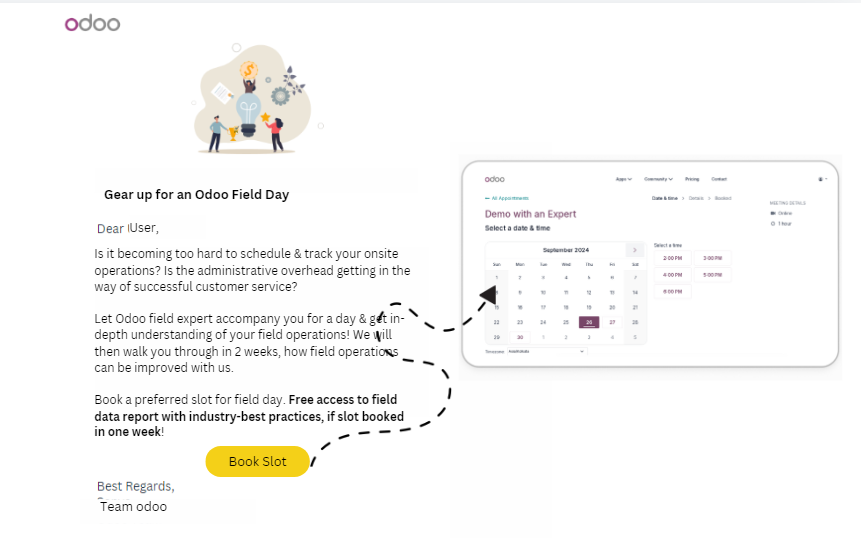

Step 1: Nudges to book Odoo Field Day

CTA to book a slot and Offer that Odoo will submit a detailed field day report with process improvement plan & industry-best practices.

Wireframe

Step 2: Field Day

🕤5 to 8 hours field-day plan

👷🏽♀️Expert accompanies field employees for 2-3 customer service requests

🗣️Becomes part of the discussions between staff & client

🤔Gains in-depth understanding of existing practices

📄Makes note of practices that can be improved via Odoo

Step 3: Report & Outcomes

📈Simulates how the shortcomings can be overcome via Odoo Field Service module & shows to the field team

📄Makes a report comparing clients’ practices vs industry-best practices

In 2 weeks time-frame, some of the key areas that may be covered in report include:

Aspect | Benefits | Industry adoption % |

Mobile Config for all field staff | - Able to record & monitor time spent - Any variation in service can be accounted for, before billing - Instant invoice to customer by field staff | 35% Key trusted clients: Mahindra & Mahindra, Apollo Tyres |

Synchronisation with Tasksheets | - Work-times & logs can be auto-synced with Tasksheets, without having to manually enter again - Managers can clearly see availability & allocate resources accordingly | 33% Key trusted clients: Apollo Tyres, Bajaj Auto |

Use-case diagram

Revenue Workings

Major contribution is from increasing seats per firm ($1.16 Mn). A sub-component of retention revenue from partner restructuring that will be in place during user lifecycle ($0.81 Mn). Total = $1.968 Mn

Metric | M1 | M2 | M3 | M4 | M5 | M6 | M7 | M8 | M9 | M10 | M11 | M12 |

License | 40 | 40 | 41 | 42 | 42 | 43 | 43 | 44 | 45 | 45 | 45 | 46 |

License: W/O plan | 40 | 40 | 40 | 41 | 41 | 41 | 41 | 42 | 42 | 42 | 42 | 42 |

User growth due to plan | 0 | 0 | 117 | 311 | 401 | 541 | 614 | 698 | 1273 | 1244 | 1431 | 2503 |

User growth rate due to plan | 0% | 0.00% | 1.12% | 2.81% | 3.42% | 4.11% | 4.21% | 4.19% | 6.71% | 5.69% | 5.69% | 8.66% |

Revenue due to User growth | $0 | $0 | $14,871 | $39,524 | $51,003 | $68,745 | $78,103 | $88,763 | $161,905 | $158,204 | $181,934 | $318,196 |

Plan of Action for single-app users

We have listed down all possibilities of users who are on one-app free plan. Idea was to prioritise the group where usage is highest & this is for the Websites section.

Possible combinations of module & features

Module | Top Feature(s) to be proposed |

Websites (eCommerce or Website Builder) | Helpdesk, Events, Appointments |

Services (Appointment) | Website, WhatsApp, Spreadsheet (BI) |

Sales (PoS or CRM) | Spreadsheet (BI), Email or WhatsApp marketing, Planning |

Marketing (Events or Surveys) | CRM, Spreadsheet (BI) |

Finance (Invoicing or Accounting) | CRM, Timesheets |

Pitch #3: To a Website user

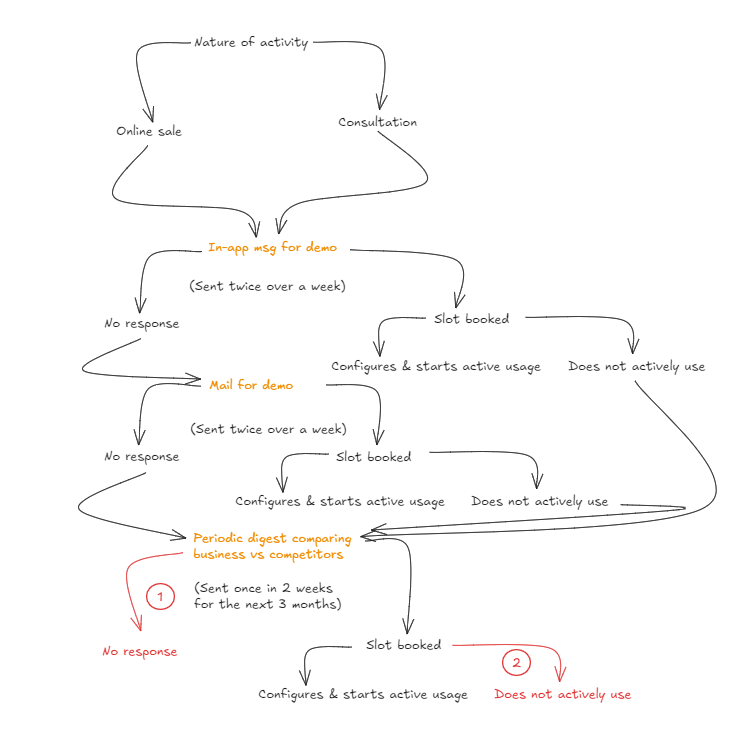

Communication flowchart

3 touch points, including in-app notification, mail & periodic digest. No staff involvement as cost would not justify LTV of customer

The Flowchart:

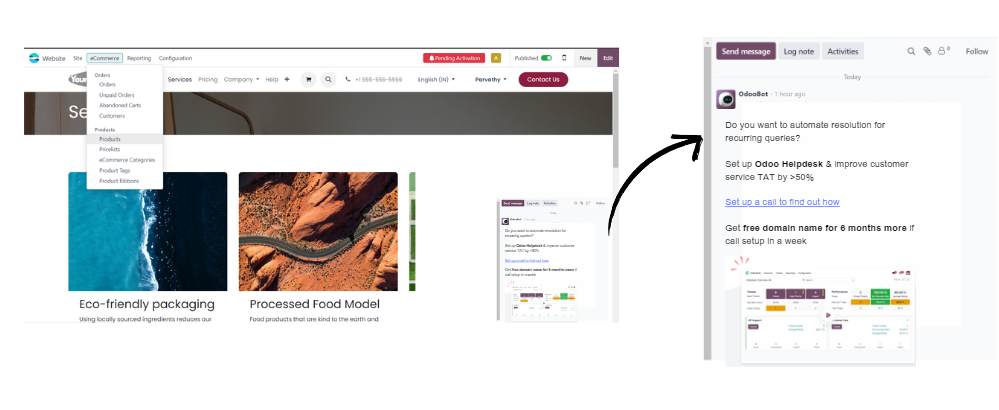

Step 1: In-app messaging

CTA to book a slot and Offer that Odoo will allow them to keep free domain name for 6 months more.

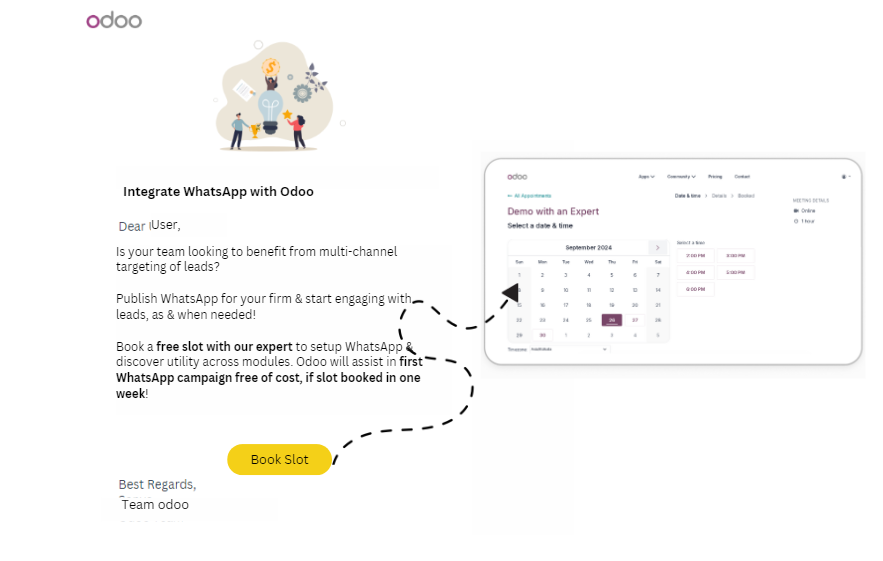

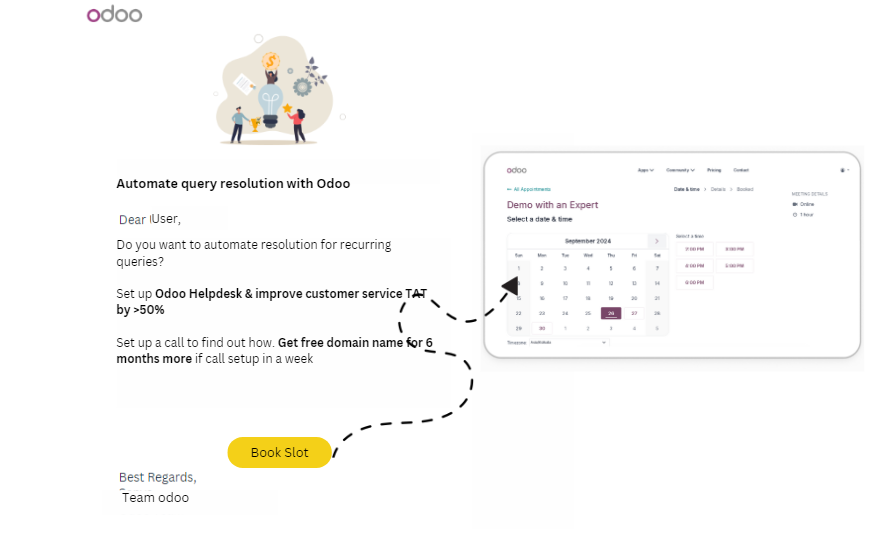

Step 2: Mail invite

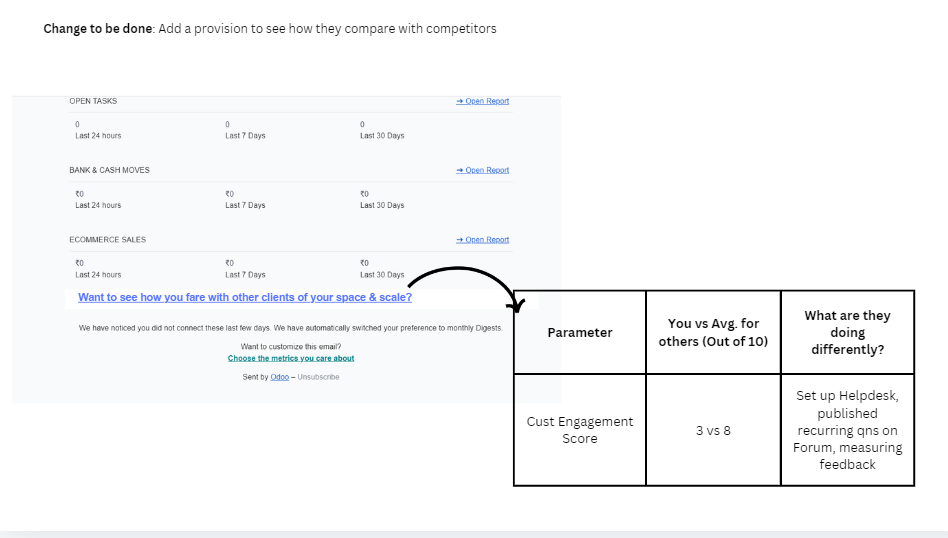

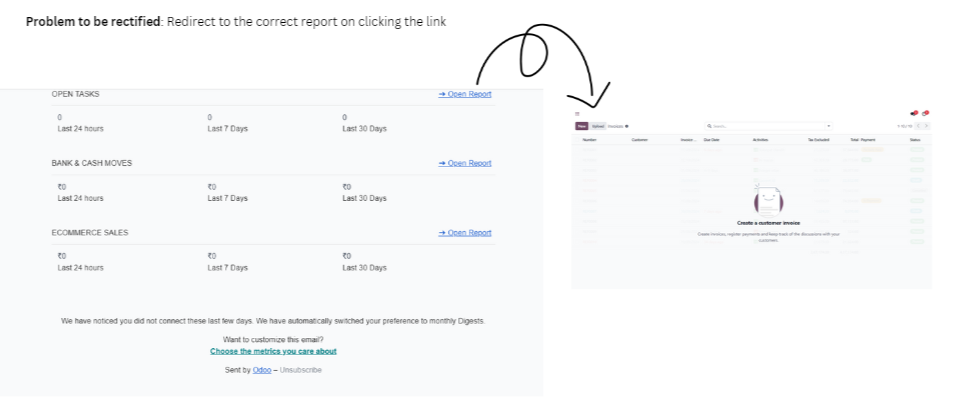

Step 3: Tweak periodic digest to compare with others of their scale & scope

Revenue Workings:

Contribution is from conversion of free to paid and the value comes up to $0.358 Mn

Parameter | M1 | M2 | M3 | M4 | M5 | M6 | M7 | M8 | M9 | M10 | M11 | M12 |

Free to paid % | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 6% |

Free to paid users | 6 | 6 | 7 | 7 | 8 | 9 | 10 | 12 | 13 | 15 | 17 | 24 |

Free to paid %: w/o E&R | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 4.5% | 4.5% | 4.6% |

Free to paid users: w/o E&R | 6 | 6 | 7 | 7 | 8 | 9 | 10 | 12 | 13 | 14 | 16 | 18 |

Revenue contribution of Free to paid | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $50,464 | $65,583 | $242,853 |

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.